what is net 15 payment terms|A Guide to Net Terms: Net 15, 30, 60, and 90 : Tuguegarao Net 15 means that a customer has 15 days to pay their invoice in full. Learn how net 15 works, see an example invoice, and compare it with other common payment terms like net 30. Tingnan ang higit pa SlipperyT is Just an individual that likes to make NSFW Minecraft smut and stuff. This comes with all 4 episodes of Jenny's Odd Adventure, with the three bonus short animations all in glorious 1080p! Seriously this is high quality Minecraft porn, take it or leave it, it is practically all bestiality with Minecraft Mobs.

what is net 15 payment terms,Net 15 means that a customer has 15 days to pay their invoice in full. Learn how net 15 works, see an example invoice, and compare it with other common payment terms like net 30. Tingnan ang higit pa

An invoice with net 15 terms means that a customer has 15 days to pay their invoice in full. Typically, the payment is due 15 days from the date that you send an invoice(when invoicing digitally), or 15 days from the date the buyer received the invoice . Tingnan ang higit paWhile net 15 is a popular invoice payment term, it is far from the only option available. Here is a closer look at other alternatives your business could consider. Tingnan ang higit pa

Many businesses that consider net 15 payment terms for their invoicing also consider net 30. Instead of giving your customers . Tingnan ang higit paLet’s take a look at an example invoice that uses net 15 terms: As you can see in this example, the terms (in this case, net 15) are listed near the top of the invoice alongside other key pieces of information that are used for accounts payable management, . Tingnan ang higit paNet 15 means that the invoice is due 15 days after the invoice date. Learn how net terms work, how to choose the right ones for your business, and how to manage them with Bill.com.Net 15 Definition: Net 15 payment terms require payment within 15 days from the receipt of the invoice. Net 15 vs Other Terms: Compared to net 30 or net 60, net 15 offers a faster . Net 15 payment terms mean the payment is due within 15 days of delivery, while net 30 terms mean the payment is due within 30 days of invoice. Learn the .

We’ll look at 15 standard accounting payment terms and how to use them in your business to streamline customer payments and stabilize cash flow. What are .

Net 15 means the customer must pay within 15 days of receiving the invoice or delivering the product or service. Learn the difference between Net 15, Net 30, and Net 60, and how to use a .

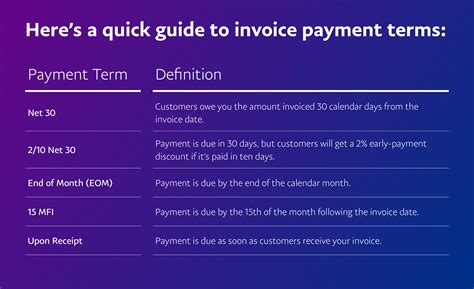

Payment terms are an agreement that outlines how, when, and by what method your customers or clients provide payment to your business. When you're running a business, it's .Net 15 is a standard payment schedule for commercial transactions. It describes the period of time a business has after receiving invoices from its suppliers before paying them. Net . When businesses refer to net payment terms, this usually refers to a period of 15, 30 or 60 calendar days before the invoice amount is due. In some cases, .what is net 15 payment terms A Guide to Net Terms: Net 15, 30, 60, and 90 Payment terms specify the exact terms and conditions of the sales agreement including when the customer must pay. For example, if your invoice includes . 15th of Month Following Invoice (or 15 MFI) specifies that payment is due on the 15th of the month following the invoice date. Other days can also be used, such as 21 MFI. Net 7, 21, 30, 60, 90: . you can consider offering discounts. For a Net 30 payment term, 2/10 Net 30, or even 2/7 Net 30, can speed up payments. Importantly, this still .

Net 10, net 15, net 30 and net 60 (often hyphenated "net-" and/or followed by "days", e.g., "net 10 days") are payment terms for trade credit, which specify that the net amount (the total outstanding on the invoice) is expected to be paid in full by the buyer within 10, 15, 30 or 60 days of the date when the goods are dispatched or the service is completed. Payment in advance is common in the legal profession and in the home improvement and landscaping businesses. 2. Net 7, Net 15, Net 30, Net 45, Net 60. Using payment terms on your invoices is .

1. Net 15 payment terms. Net 15 means that you’re offering your customers 15 days to pay their invoice or the total order amount in full. This can be applied after the order has been delivered or fulfilled by you. 2. Net 30 payment terms. Net 30 means that you’re offering your customers at least 30 days to pay their invoice or the total .

Net 21. Payment is due 21 days from the invoice date. Net 30. Payment is due 30 days from the invoice date. This is one of the most common payment terms for small businesses and freelancers. EOM. Payment is due at the end of the month in which the invoice is received. 15 MFI.A Guide to Net Terms: Net 15, 30, 60, and 90 30 days payment terms are often referred to as net 30 on invoices. This means that customers are granted a payment period of 30 calendar days (not working days). The shortest form on a bill looks like this: "Payment terms: net 30". Instead of 30 days, you can also give your customers a shorter or longer payment term, for example .

15 Accounting Payment Terms and How to Work With Them. . 2/10 Net 30: This term means that payment is due in 30 days, but the customer can receive a 2 percent discount for payment within 10 days.

英文と日本語のビジネス契約書の作成・チェック(レビュー)・翻訳の専門事務所です。(低料金、全国対応)英文契約書の代金支払条件の条項であるPayment Termsについて解説します。いくつかの例文をとりあげ要点と対訳をつけ、基本表現に詳しい注記を入れました。

Here are some common payment term examples you should know: Net 7/10/15/30/60/90. Net terms specify the number of days a client has to pay an invoice. The most common net term is Net 30, which means payment is due by the 30th day from the invoice date. The 30th day following the issue date serves as the invoice due date. Net 15 payment terms is a type of payment plan where customers are given 15 days from the date of purchase to make payments. This type of payment plan is popular among businesses because it offers flexibility to customers while also encouraging timely payments. Additionally, net 15 payment terms can help businesses reduce their .

Net payment terms are when you offer your customers a fixed amount of time to pay you back. Net 30 day terms are the most commonly used payment terms. . Terms of Net May 15 means that .If the payment term is “ 15 MFI”, it means that payment is due on the 15th of the month following the invoice date. For 15 MFI, there are two possible scenarios: 1. The invoice is issued on a date after the 15th. .what is net 15 payment terms Payment terms are the conditions on an invoice dictating what, how, and when a buyer will pay the seller for a purchase. Learn about its importance. . Net 7, Net 10, Net 15, Net 60, Net 90, Net xx, . Here are types of payment terms for businesses: Net 7, 10, 15, 30, 60, or 90: With this payment term, payment is expected within 7, 10, 15, 30, 60, or 90 calendar days from the invoice date. 2/10 Net 30: When you give customers a 2/10 Net 30 payment term, you're telling your customer that although the invoice is due in 30 days, you'll give .Some allow as few as seven days or as many as 180 days. The most common net terms are Net 30 (30 days until full payment is due), Net 60 (60 days until full payment is due), and Net 90 (90 days until full payment is due). It’s important that businesses check the payment terms of a trade credit agreement and ensure that this allows them enough .

Net 30 terms are often coupled with a discount for early payment to encourage the client to pay more quickly. For example, small business owners will often offer net 30 terms with a 2 percent payment discount if the client offers a full payment within 10 days. On contracts and invoices, you’ll see these terms written out as “2/10 net 30.”.

When this term is included on an invoice, it means the customer has 30 days to pay the total. With net 30, you’re extending credit to your customer and allowing them to purchase services and products without paying upfront. Another term for extending credit to customers is trade credit. This is a business-to-business agreement that works .For example, if an invoice includes 1/15 - net 30 listed under terms, the 1 is the percent of discount offered, the 15 is how many days the customer has to pay the bill to receive the discount, and the net 30 is the final due date for the full amount to be paid. . There are two methods for recording an early payment discount: net and gross .

what is net 15 payment terms|A Guide to Net Terms: Net 15, 30, 60, and 90

PH0 · What are Invoice & Payment Terms?

PH1 · What Does Net15, Net30, and Net60 Mean?

PH2 · Understanding Net 15 Payment Terms: Everything You Need to

PH3 · Understanding Net 15 Payment Terms: Boost Your Cash Flow

PH4 · Top 10 Payment and Invoicing Terms You Should Know

PH5 · Net Terms Guide: What Are Net 30/60/90 Terms?

PH6 · Net 15: What Is It And What's The Difference Between Net 30

PH7 · Net 15 Payment Terms: What Are They & How Do They Work?

PH8 · Net 15 Payment Terms: What Are They & How Do They Work?

PH9 · A Guide to Net Terms: Net 15, 30, 60, and 90

PH10 · 15 Accounting Payment Terms and How to Work With Them